One of the most common interview questions will be one exploring your choice of career such as – Why did you choose a career in Accounting and Finance?

In this post we give you our top tips on how to answer that questions if posed in an interview. If you are embarking on your work journey or looking to change careers this post is for you also.

We review reasons why Accounting and Finance is such a great career choice, we outline the skills ideally suited and we help you with answering this common interview question and provide sample answers to help.

Your motivation for choosing a career in Accounting and Finance

Let’s for a moment explore why you may want a career in this exciting and rewarding sector.

Ask yourself, what is your main interest in embarking on a career in Accounting and Finance? Maybe you are good with numbers and enjoy working with them, lots of people do.

Whatever your reason may be, an interviewer will almost certainly ask you what it is. This is why providing a thoughtful and sincere response is important. A recruiter will need to understand your commitment to the role, as well as your suitability.

Know What To Say on Your Application and Interview

A career in accounting and finance offers many challenging opportunities

In the UK, there are lots of career opportunities in the fields of accounting and finance. One of the most well-used routes is through Finance Graduate Schemes offered by larger financial institutions.

These schemes provide training and hands-on experience in various areas such as accountancy, banking, finance and insurance. An FGS often leads to professional qualifications and allows for specialisation in areas such as investment banking, data science, underwriting and risk management.

There are also Graduate Accounting Finance Jobs available for fresh graduates. For example, things such as Accountant, Graduate Development Scheme, and Graduate Finance Apprenticeship are among those commonly advertised.

These positions offer practical “on-the-job” experience and can serve as a stepping stone to more advanced roles in the industry.

It is also worth mentioning that many of the major banks, financial institutions, and insurance companies in the UK run graduate schemes.

These include:

- Bank of England

- Barclays

- HSBC

- J.P. Morgan

- Lloyds Banking Group

- Nationwide Building Society

- NatWest Group

- Santander

- Aon

- Aviva

- Lloyd’s of London

Their programs provide excellent opportunities for graduates to gain industry experience and hone their skills.

The responsibilities of a career in Accounting and Finance

The responsibilities that come with a career in Accounting and Finance are varied and will depend on the position itself. However, the most common responsibilities are as follows:

- Auditing and Analysing Finances: Accountants are responsible for auditing and analysing the financial data of a company. They make sure of the accuracy of financial records and identify any areas that need improvement

- Ensuring Financial Compliance: They make sure financial statements comply with applicable laws and regulations.

- Financial Forecasting: A career in Accounts and Finance also means playing an important role in financial forecasting. To do this they use historical data, market trends, and various other metrics to make informed decisions.

- Preparing and Filing Tax Returns: It is the responsibility of an accountant to prepare and file tax returns for a company.

- Risk Analysis: An accountant performs risk analysis to ensure the financial stability of the company.

Top reasons for choosing a career in Accounting and Finance?

You may be asked this question either on your application, in your interview or possibly both. It is an interview question that comes up a lot, especially for a career that involves a lot of responsibility.

Some common variations of this question that may be put to you:

- Can you share your motivations for pursuing a career in accounting and finance?

- What attracts you to the field of accounting and finance?

- What inspired you to apply to work with us in particular?

Effectively showing your commitment to a career in Accounting and Finance is important here. It is also helpful to answer this question in such a way that you are showing the recruiter that you are thinking of your future aspirations and career progression.

It is never easy to answer these types of questions, especially when you are in the hot seat and they are waiting for you to speak. To help you plan for this, answer with confidence, and help plan your career, here are several reasons why you might be considering a career in Accounting and Finance:

- Job demand and security: The financial sector is an important part of the economy and always will be, meaning it will always be in demand. Businesses, governments, and individuals all require financial services, and this provides job security.

- Career diversity: The world of accounting and finance is a broad one and it offers a wide range of career path choices. These could include work in areas like auditing, tax, financial analysis, management accounting, and more.

- Intellectual challenge: If you have an analytical mind and enjoy problem-solving, and dealing with complex systems, a career in this field could be intellectually fulfilling.

- Professional Development: A lot of roles in finance offer opportunities for ongoing

learning and professional growth. You can also gain professional qualifications.

How would you answer the interview question: Why have you chosen a career in Accounting and Finance?

Here is a snippet of sample interview answer to inspire you. In your interview you would of course make it personal to you – the interviewers will want to hear enthusiasm and energy when you speak.

I chose a career in accounting and finance because I have always been fascinated by the way financial decisions impact a company’s performance and strategy. My natural aptitude for numbers and detail-oriented analysis, combined with my interest in business operations, drew me towards this field. I appreciate the structured, logical approach required in accounting, and I thrive on the challenge of navigating complex financial landscapes to find effective solutions. Moreover, this career path offers substantial opportunities for professional growth, stability, and the chance to work in various industries. It aligns with my long-term career goals and my passion for contributing to a business’s success through sound financial management.

Expert STAR Sample Answers for Your Application and Interview

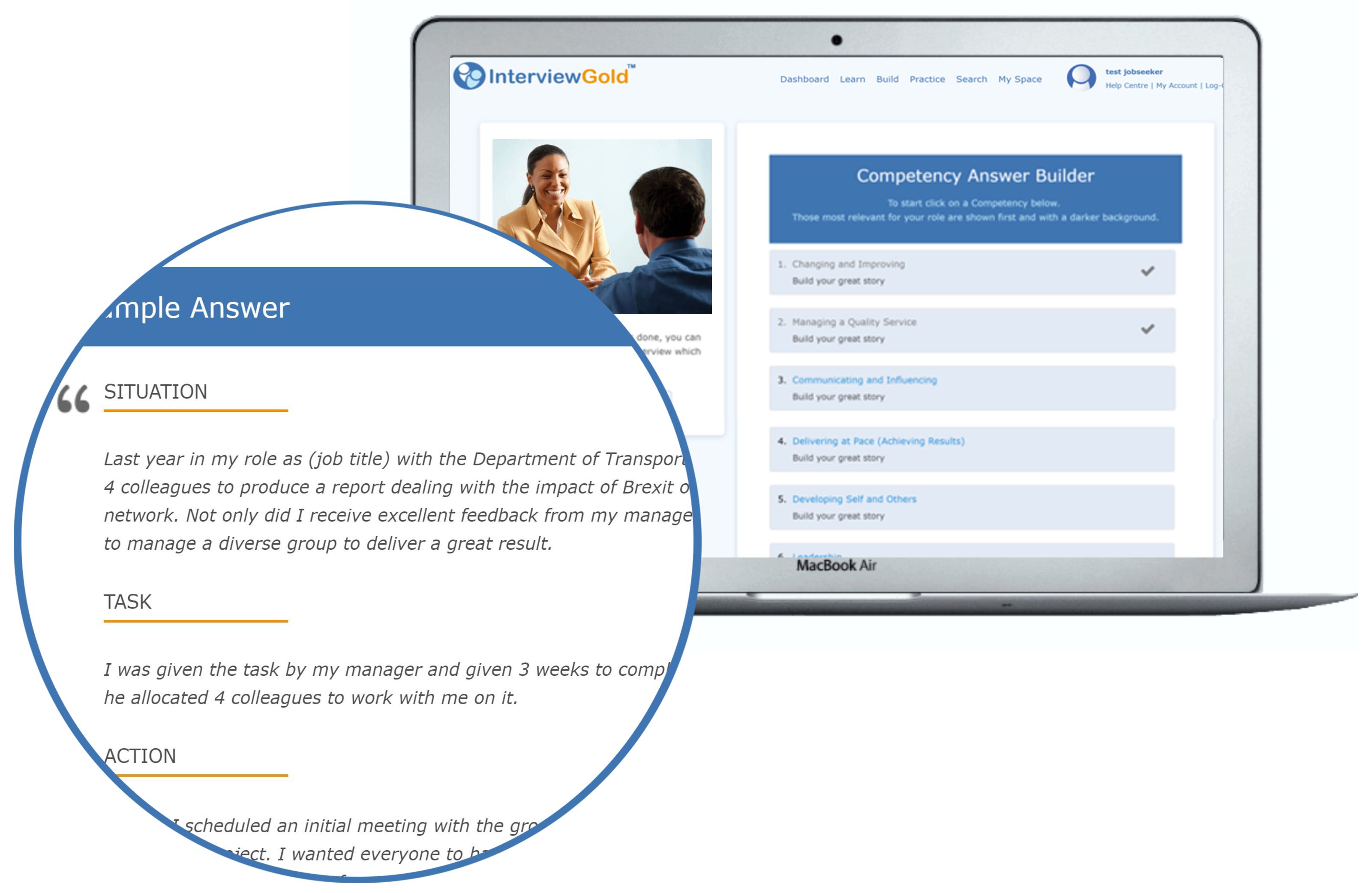

When you join InterviewGold, you get instant access to expert STAR answers, job specific questions.

Plus the powerful answer builder tool will help you create brilliant answers in minutes.

What skills are required for a career in Accounting and Finance?

You may be asked a follow on interview questions about the skills that make a good accountant or finance person. They will want to hear that these are the skills that you bring.

There are a some key skills and abilities that you will need to have for a successful career in Accounting and Finance, as you can probably imagine. The following is a rundown of some of the more important ones.

- Numeracy is important and involves the use and application of numerical data.

- Accountants need to be familiar with the standards for preparing accounts. In the United Kingdom, for example, the Generally Accepted Accounting Practice (UK GAAP) determines these standards.

- Proficiency in reading and understanding financial documents, including balance sheets, income statements, cash flow statements, and annual reports is vital.

- Strategic and critical thinking is the most in-demand skill for finance professionals.

- Communication and storytelling skills are important when it comes to explaining complicated financial information so it is clear and understandable.

- Being able to accurately interpret and draw insights from financial data is becoming more important in today’s data-driven world.

- A level of proficiency in finance-related software is often required, or at least desirable.

What type of person thrives in a career in Accounting and Finance?

There are lots of disciplines involved in the world of Accounting and Finance and a wide range of roles for people to consider a role in.

With that in mind, what type of person would typically do well in a career such as this? To help you, consider the following attributes and see how many sound like you.

- Do you have an analytical mindset: People who enjoy working with numbers, analysing data and solving problems would likely do well in a career in this field.

- Have an eye for detail: Accounting and finance professionals deal with complex financial data regularly, so they need to have a keen eye for detail to make sure of accuracy.

- Unwaveringly ethical, professional standards: Because of the sensitive nature of financial information, professionals in this field should have a high level of ethical standards.

- A professional interest in continuous learning: The world of Accounting and Finance is constantly evolving, so being willing and able to stay updated and learn new skills is important.

You should remember, that these attributes are listed to give a general idea of what could be required and that individual roles and companies may have different requirements.

What qualifications are required to apply for a career in Accounting and Financing?

To pursue a career in accountancy and finance, you will typically need the following qualifications:

Educational Degree

A bachelor’s or master’s degree in a relevant field such as accounting, finance, business or economics is often required. And if you don’t have a degree?

It’s possible to pursue a career as a chartered accountant even if you don’t have a degree. The ACCA qualification is accessible to those with a mix of GCSEs and A-levels.

However, If you already possess a Degree in any discipline, you might be excused from certain examinations. You may even have the opportunity to join the accounting field and commence your studies at the foundational level.

Professional Certifications

Many employers and recruiters require prospective candidates to have professional certifications. Some of the key, relevant professional qualifications:

- Chartered Financial Analyst (CFA): You need a relevant Bachelor’s Degree in finance before undertaking this course.

- Associated Chartered Accountant (ACA): To become a chartered accountant, you’ll need to undertake in-depth accountancy training and pass professional exams with a recognised industry body (such as the ICAEW or ACCA).

- Association of Chartered Certified Accountants (ACCA) qualifications.

- Certified Public Accountant (CPA): A common certification required for accounting jobs.

Other skills

Aside from academic, and professional qualifications and certifications, you will need more than just being good at maths.

Analytical, interpretation and adaptability are attributes that are also important and required to communicate accurate financial information, put forward realistic targets and drive business growth.

Keep in mind that these qualification requirements can vary depending on the specific role and the company you apply to.

So, how do I apply for a career in Accounting and Finance?

If you are considering this sector, here are some tips to help you get started on your accounting and finance career.

It’s fairly easy these days to find and apply for jobs that you might have an interest in, including Accounting and Finance. There are some steps to follow when applying for your new job:

Find suitable jobs for your qualifications and experience

You can normally find these positions either on the websites of financial institutions (banks, for example), some larger companies may advertise on their website under a ‘Careers’ page, and there are many general recruitment websites too such as Indeed.

Do your due diligence and research the position you want to apply for

Before you apply for a job in Accounting and Finance, you need to make sure that you and the job are a good fit for each other. Learn what is going to be expected from you in that role.

If you apply to be a bookkeeper at your local store, only to find out much later that your talents would be better used at a bank, then you aren’t going to be as happy or satisfied.

Get your application prepared

Set some time aside to prepare your application. Most employers require you to include a CV and a cover letter with your application form. Use this as an opportunity to create a lasting first impression, highlight your abilities, and put an emphasis on your accomplishments. The skills and experiences that you mention should be relevant to the position you are applying for make sure you customise your responses to fit the job role.

After you have finished your application, read through everything to make sure that you have not made any mistakes.

The application process

Your application goes through several steps, after you have narrowed your job options, and are detailed below.

Initial application: You will start with a simple application process, that can vary from CVs, detailed cover letters, and an application form. You might also have to complete comprehensive application questionnaires.

The interview: Interviews in the Accounting and Finance sector are likely to be the next step in the process. These interviews could take place either in person or through virtual platforms.

Assessment Centres and Psychometric Evaluations: Larger companies may invite you to an assessment centre next, where they undertake a series of short psychometric evaluations. These assessments may include exercises in financial analysis, ethical decision-making scenarios and group activities with other candidates.

Second Interview: It is fairly common for there to be a second round of interviews, especially if there are a lot of candidates.

The world of accounting and finance can be a challenging one, but if you are ready to meet it then it can lead to a rewarding career.

How InterviewGold Will Help You Make Perfect Applications and Get Jobs

With the InterviewGold online training system you have access to a host of great content all designed to help you make great job applications.

You get sample answers, cover letters and personal statements. Plus the powerful Answer Builder tool creates winning answers in second to use in any application or interview.